charitable gift annuity calculator

Using a present value of an annuity calculator you determine that the present value is 4714068. The ACGAs current suggested maximum payout rates exceed the current maximum payout rates allowed by the State of New York at the ages.

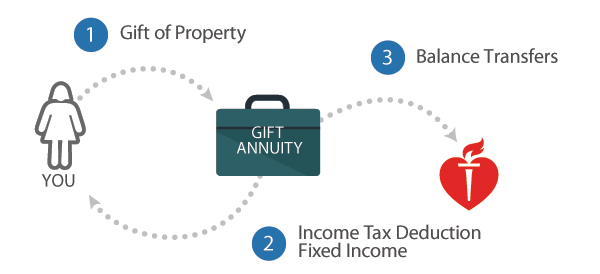

Gifts That Pay You Income American Heart Association

Charitable Gift Annuity Calculator.

. Payments may be much higher than your return on. Wills Trusts and Annuities Home Why Leave a Gift. Email protected Our Sites.

The results will provide an overview of benefits including. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Payments may be much higher than your return on securities or CDs.

Cultivating a Healthy School Culture. Charitable Gift Annuity Calculator You can make a gift to NGAF and receive guaranteed fixed payments for life. You paid 100000 for the annuity.

Please click the button below to open the calculator. Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. Others require you to be at least 65 years old to start receiving payments.

Ways to Gift. Charitable Gift Annuity Calculator. Complete the form below to calculate your income for life and tax benefits or contact.

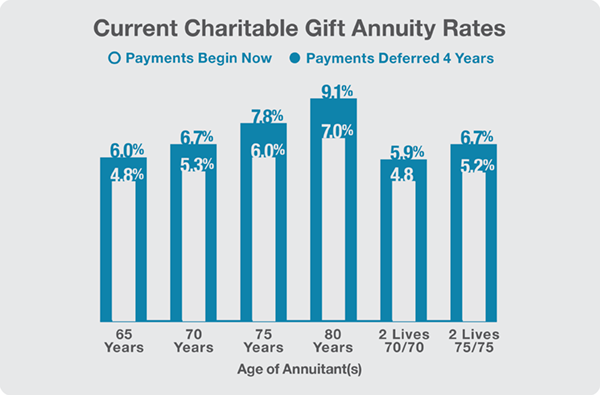

Our Gift Planning department has a representative in your area who can provide further information or help you prepare the right questions to ask your financial advisor to determine. You can expect a tax deduction of. Current gift annuity rates are 49 for donors age 60 6 for donors age 70 and 77 for donors age 80.

Deferred Charitable Gift Annuity Calculator. The American Council on Gift Annuities offers updates for the suggested current. Gift Calculator Gift Calculator Use this free no-obligation tool to find the charitable gift thats right for you.

Simply input the amount of your possible gift the basis of the property and the ages of the planned income recipients. Many charities require a minimum 10000 to 25000 initial donation to fund the annuity. Our gift calculators show you how a gift to the American Heart Association provides benefits to you and your loved ones while continuing to fight heart.

Our most recent analysis reveals that the ACGA rates exceed the maximum New York rates applicable to gift annuities funded in October December 2021 for females at ages 45 through 88 and for males at ages 46 through 85. Thats pretty much the. A great way to make a gift to Oregon State University Foundation receive payments that may increase over time and defer or eliminate capital gains.

Calculate deductions tax savings and other benefitsinstantly. Well also estimate the amount of your expected annuity payment through a charitable gift annuity calculator. 615 Chestnut St 17th Floor Philadelphia PA 19106-4404 USA Telephone.

Legal Name Address and Tax ID Catholic Relief Services - USCCB 228 West Lexington. Charitable Remainder Unitrust Calculator. Charitable Gift Annuity Calculator You can make a gift to American Heart Association and receive guaranteed fixed payments for life.

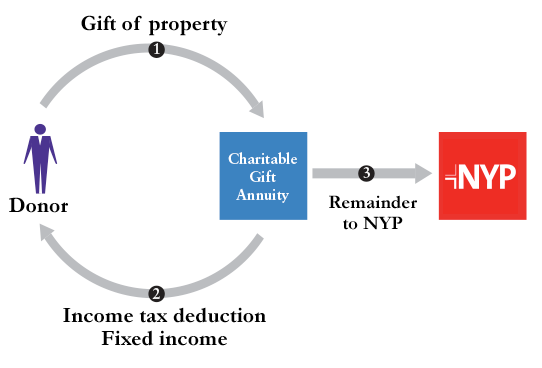

Nyp Giving Planned Giving Gifts That Provide Income Charitable Gift Annuity Nyp

Uo Gift Planning Charitable Gift Annuities

Benefits Calculator The Michael J Fox Foundation

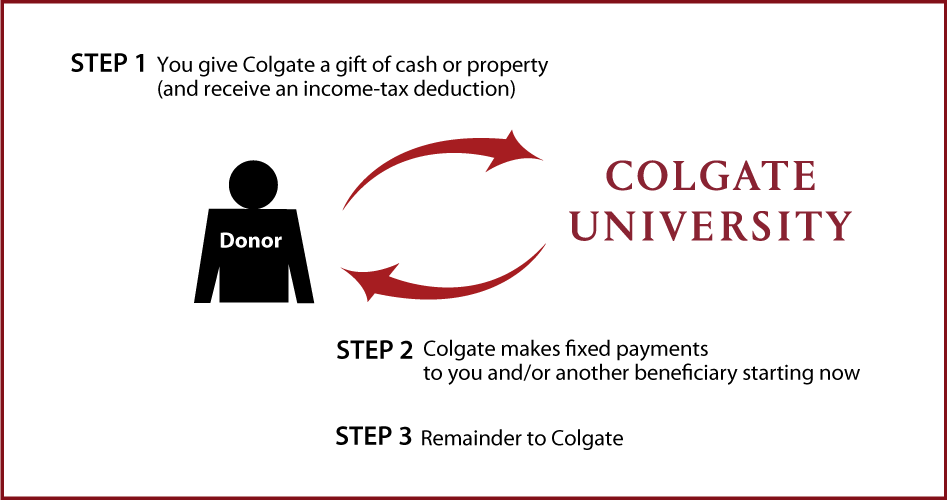

Colgate Planned Giving Charitable Gift Annuity

Charitable Gift Annuities University Of Montana Foundation University Of Montana

Charitable Gift Annuities For Ministries Christian Financial Advisors

Charitable Gift Annuities Bogleheads Org

Gift Calculator Harvard Medical School

Gifts That Provide Income Giving To Mit

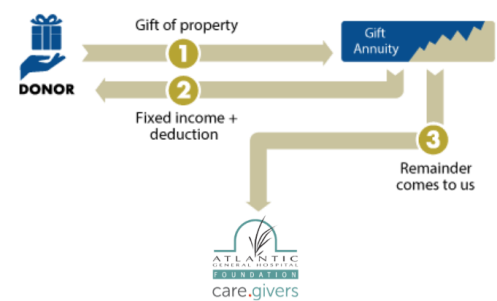

Planning Your Legacy Atlantic General Hospital In Berlin Md

Giftlegacy Presents Calculator Main Page

A Gift That Pays You Back Giving To Johns Hopkins

The Cmc Charitable Gift Annuity Claremont Mckenna College

Charitable Gift Annuity Calculator Jewish Federation Of Metropolitan Detroit

Gift Calculator Union Of Concerned Scientists